Open topic with navigation

Recording Bank Deposits

- The Bank Deposit allows you to tick off cash and cheques recorded in the system that are going to be deposited at the bank.

- The following criteria is required for a transaction to be listed to be ticked off:

- The Transaction type is Receipt, Debtor Cash Sale or Creditor Cash Credit

- The @ Bank date field on the transaction must be blank

- Once a Bank Deposit record is saved a Bank Deposit slip can be printed out.

- Bank Deposit records will show on the Bank Reconciliation screen to be reconciled.

Menu

Mandatory Prerequisites

Prior to recording Bank Deposits refer to the following Topics:

- Transactions containing monies to be banked - These are Receipts, Debtor Cash Sales and Creditor Cash Credits.

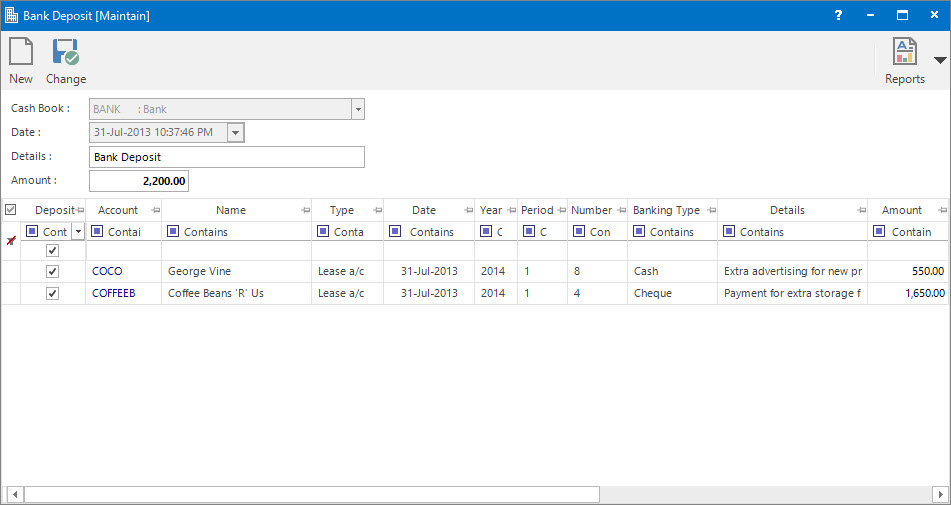

Screenshot and Field Descriptions

Cash Book: this is a drop down list of the Cash Book (Bank Account) chart of accounts.

Cash Book: this is a drop down list of the Cash Book (Bank Account) chart of accounts.

Date: this is the date the money will be deposited. The time will be saved on the record as well as it is possible to save multiple deposits per Bank per day.

Date: this is the date the money will be deposited. The time will be saved on the record as well as it is possible to save multiple deposits per Bank per day.

Details: this is an optional description.

Amount: this is an automatically generated total of the transactions that are selected to be deposited.

Deposit Items table: this contains rows of transactions to be deposited - typically cash and cheques. Entries are selected / deselected by clicking the check box in the Deposit column. By default only transactions up to the Date selected will be shown.

How Do I : Search For and Maintain Entities

These General Rules are described in the Fundamentals Manual: How Do I : Search For and Maintain Entities

How do I : Add a new Bank Deposit

- Select a Cash Book (Bank Account) from the drop down list.

- The Deposit Items table will populate with transactions to be deposited.

- Change the deposit Date if required.

- Change the default text in the Details field if required.

- Select the transactions to be deposited by clicking the check box in the Deposit column of the Deposit Items table.

- Click the Application tool-bar push button: Add and confirm that you wish to add the new record.

How do I : Modify an existing Bank Deposit

- Click the Application tool-bar push button: Search to select the existing Bank Deposit record.

- The Deposit Items table will populate with transactions relating to this deposit.

- Change the text in the Details field if required.

- Select / deselect the transactions to be deposited by clicking the check box in the Deposit column of the Deposit Items table.

- Click the Application tool-bar push button: Change and confirm that you wish to change the record.

How do I : Print a Bank Deposit Slip

- Click the Application tool-bar push button: Reports and select Bank Deposit.

- The parameters for the current Bank Deposit will be transferred to the Report parameter screen.

- Refer to "How Do I : Print a Bank Deposit Slip" for the steps to print.

How do I : Delete an existing Bank Deposit

- Click the Application tool-bar push button: Search to select the existing Bank Deposit record.

- While the Application tool-bar push button: Delete is available, click it and confirm that you wish to delete the record.

A Bank Deposit record can only be deleted if it has not been saved in a Bank Reconciliation.

Related Topics

- Creditors Bond Account - Cash Credit Transaction.

- Creditors Bond Account - Receipt Transaction.

- Debtors Bond Account - Cash Sale Transaction.

- Debtors Bond Account - Receipt Transaction.

- Debtors Sundry Account - Cash Sale Transaction.

- Debtors Sundry Account - Receipt Transaction.

- Creditors Trust Account - Cash Credit Transaction.

- Creditors Trust Account - Receipt Transaction.

- Debtors Trust Account - Cash Sale Transaction.

- Debtors Trust Account - Receipt Transaction.

Cash Book: this is a drop down list of the Cash Book (Bank Account) chart of accounts.

Date: this is the date the money will be deposited. The time will be saved on the record as well as it is possible to save multiple deposits per Bank per day.